In the world of accounting and taxes, the term “entity tax election” holds significant weight. This seemingly simple decision can have a substantial impact on how taxes are paid and the overall tax burden.

Entity election question is the first one I usually ask when I conduct a tax consult. A common response often heard is, “I am an LLC.” But let’s debunk a misconception right off the bat – an LLC is not an entity tax election. Instead, it’s a legal structure designed to offer limited liability protection to owners. This article will delve into the tax implications of different entity elections, shedding light on the distinction.

Without a tax election, an LLC defaults to being a disregarded entity. In simpler terms, a single-member LLC gets taxed as a sole proprietorship, while a multi-member LLC is treated as a partnership. This results in a single-member LLC filing taxes using Schedule C and a multi-member LLC submitting an informational return (Form 1065) along with K-1 forms for each partner, which subsequently affects their personal returns.

However, an LLC can opt for an entity tax election, specifically choosing to be taxed as either an S Corporation or a C Corporation.

Deciding to elect S-Corp taxation is a significant consideration for business owners, frequently ranking as one of the most common queries they face. Before delving into the factors influencing this decision, it’s vital to understand the perks of an LLC taxed as an S-Corp versus one taxed as a sole proprietorship.

LLC taxed as a sole proprietorship (default)

Sole proprietors pay taxes on their business’s net income, incurring self-employment taxes of roughly 15.3%. Additionally, their business income becomes part of their taxable income for federal tax calculations. Sole proprietors usually don’t take salaries but can withdraw owner draws that aren’t tax-deductible.

One notable benefit sole proprietors enjoy is related to employing their children. When children work legitimately in the business, their wages are exempt from federal taxes under standard deduction rules. Moreover, if the child is below 18, their wages are free from payroll taxes. This benefit is not extended to S-Corp owners employing their children.

LLC taxed as an S Corp

S-Corp income bypasses direct taxation and is instead attributed to the shareholder/owner for federal tax purposes. A separate informational return (K-1) is filed, detailing the distribution to be included in personal tax returns. Shareholder/owner MUST pay themselves a reasonable salary-more on that later-and related wages and employer portion of payroll taxes is tax-deductible. S-corporation owners can take distributions which are essentially tax free as long as reasonable compensation is paid and there is enough basis (equity) in the business.

LLC taxed as a C Corporation

Some advantages of electing to be taxed as a C-Corp are as follows:

- Where personal tax rates might be higher than the corporate tax rates of 21% it might make sense to make the election.

- C-Corporations generally enjoy a wider array of deductions.

- C-Corporations make it easier to attract investors.

One major disadvantage of course is double taxation-the C Corporation pays taxes on the profits and the owners are taxed on the dividends the corporation distributes to them.

The Role of Reasonable Compensation

The notion of “reasonable compensation” is pivotal in S-Corp taxation. An S-Corp (and C-Corp) owner must pay a reasonable salary to themselves, which at the most basic level means compensation they would receive for like work performed elsewhere. However, S-Corp owners often engage in a multitude of tasks beyond their primary role, and “reasonable compensation” most often becomes the cost of replacing tasks performed by the shareholder/employee, including low value tasks.

It’s prudent to enlist tax professionals to conduct a comprehensive reasonable compensation study to determine proper compensation levels adhering to IRS guidelines and methodology. A lot of business owners assume a percentage of profits, or the entirety of their net income can be paid out as reasonable compensation but that would be wrong.

Qualified business income deduction

Before the 2017 Tax Cuts and Jobs Act, choosing to be an S-Corp was almost always more advantageous from a tax perspective. You essentially lowered your taxable income by the amount of wages and related payroll taxes paid to the owner/shareholder compared to a sole proprietorship Schedule C.

Like most things in the IRS tax code, qualified business income deduction is a complicated subject. This deduction was codified in 2017 to level the tax playing field between corporations which currently enjoy a flat 21% corporate tax rate and small business owners-sole proprietor Schedule Cs and S-Corps alike.

The calculation for this deduction is generally 20% of Qualified Business Income, however there are a lot of variables that go into it, and QBID is subject to income phase outs. I would say the biggest factors affecting QBID would be the reasonable compensation levels (appropriately set via a reasonable compensation study) as well as SSTB designation (specialized service trade or business) designation.

An SSTB is generally a trade or business involving performance of services in the fields of law, health, accounting, consulting, financial services and any trade or business where the principal asset is the reputation or skill of one or more of its employees or owners.

QBID calculations for anyone who is designated as an SSTB takes on a whole new level of complexity, especially if you are nearing higher income limits ($185,500 in taxable income as a single taxpayer or $364,200 as a married filing jointly taxpayer).

Factors to consider for Qualified Business Income Deduction:

- Taxable income levels subject to limits and phase-outs

- SSTB (Specialized Service Trade or Business designation)

- Reasonable compensation levels for owner/shareholder

- Wages for non-employees

- Any property owned by the LLC

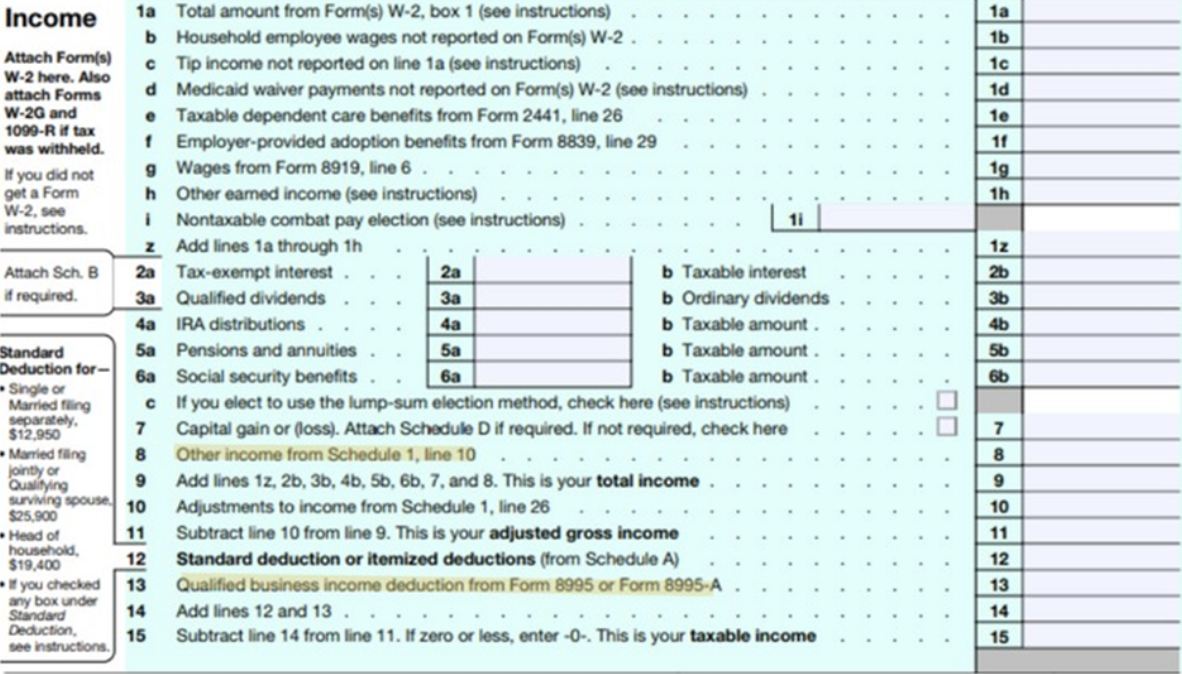

Qualified Business Income deduction appears on your 1040 and lowers your overall taxable income:

An Informed Decision

Deciding on an entity tax election, especially opting for S-Corp taxation, is no trivial matter. It requires a holistic analysis, considering income levels, reasonable compensation, SSTB designation, and other variables as noted earlier.

While empowering business owners to grasp the nuances of their tax obligations is vital, there’s equal wisdom in recognizing when to seek professional guidance. The introduction of QBID has heightened the intricacies of entity elections, fostering an environment where personalized circumstances heavily influence the decision-making process.

This is a contributed piece published by Anna Ortiz. Now the owner of North Shore Accounting Services, Anna has been in the accounting field for over 20 years. A 2001 Northeastern University graduate, Anna has a degree in Finance and has worked as an accountant ever since, becoming a CPA in 2018. Anna focuses on helping service-based businesses make sense of their numbers, set and achieve their business goals by providing quality accounting, tax and advisory services. She is passionate about educating her client base, because let’s face it-knowledge is power. Anna is the host of the Growth Advisor Podcast.

Are you interested in writing an article for Massachusetts Business Network? Please fill out our contact form.

Leave a Reply